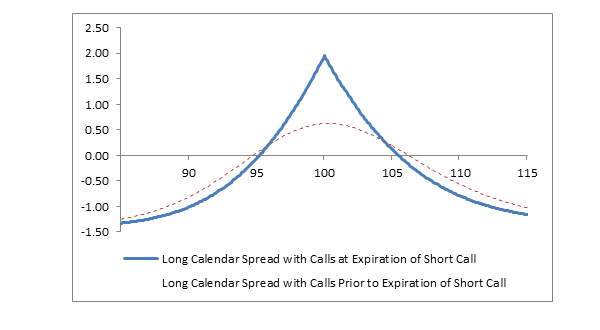

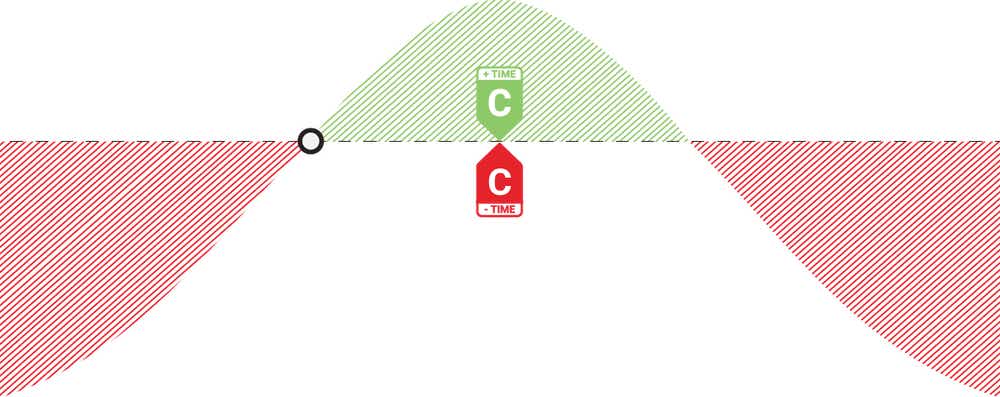

What Is Calendar Spread – A calendar spread, as the name suggests is a spread strategy wherein you trade on the gap between two similar contracts rather than betting on the price. This is considered to be relatively low . The long call calendar spread is engineered to allow you to profit from fluctuations in time value. A so-called horizontal spread, the trade involves the sale of a shorter-term call and the .

What Is Calendar Spread

Source : www.investopedia.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

Long Calendar Spread with Calls Fidelity

Source : www.fidelity.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

Long Calendar Spreads for Beginner Options Traders projectfinance

Source : www.projectfinance.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

The Poor Man’s Covered Call (and other Calendar Spreads) : r

Source : www.reddit.com

Option Calendar Spreads CME Group

Source : www.cmegroup.com

Getting Started with Calendar Spreads in Futures Exegy

Source : www.exegy.com

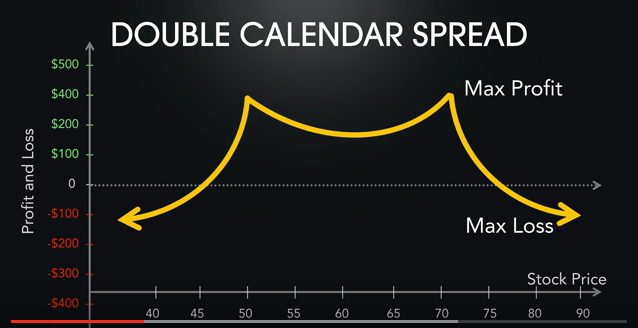

The Double Calendar Spread

Source : www.options-trading-mastery.com

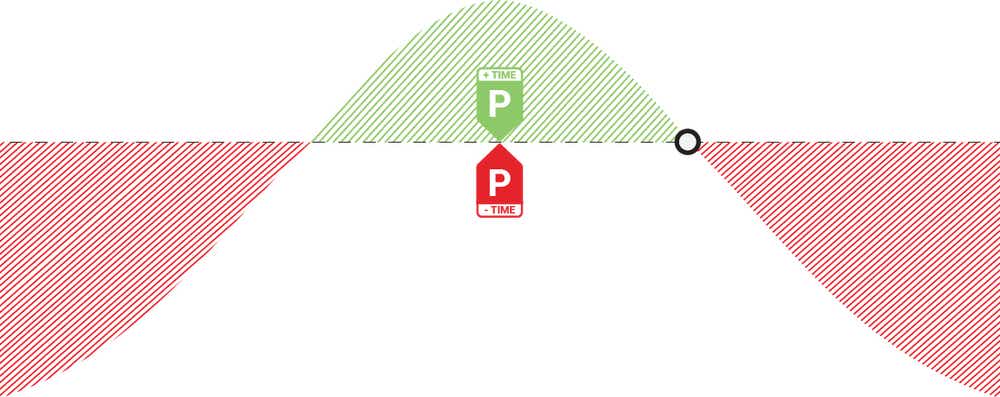

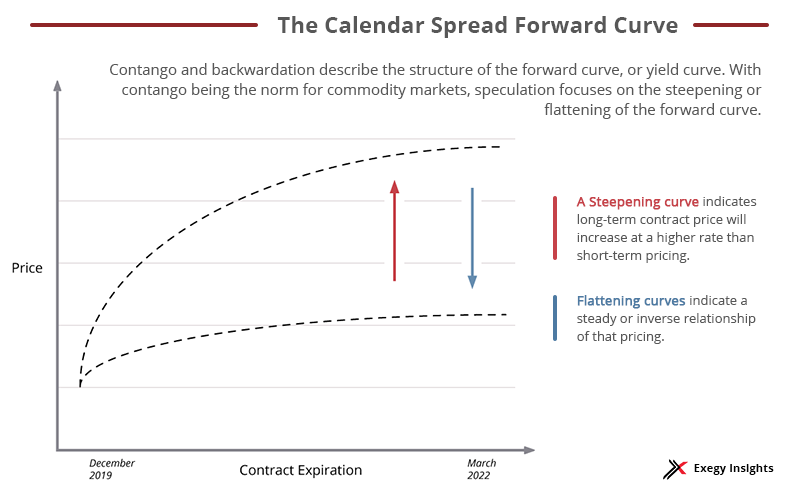

What Is Calendar Spread Calendar Spreads in Futures and Options Trading Explained: Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati . The long put calendar spread is a strategy designed to profit from a near-total coma in the underlying shares. Employing two different put options spread across two calendar months — with a .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)